- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

The math for buying a home no longer works, per WSJ

Posted on 12/20/23 at 9:04 am

Posted on 12/20/23 at 9:04 am

unusual whales

unusual whales tweets:

quote:

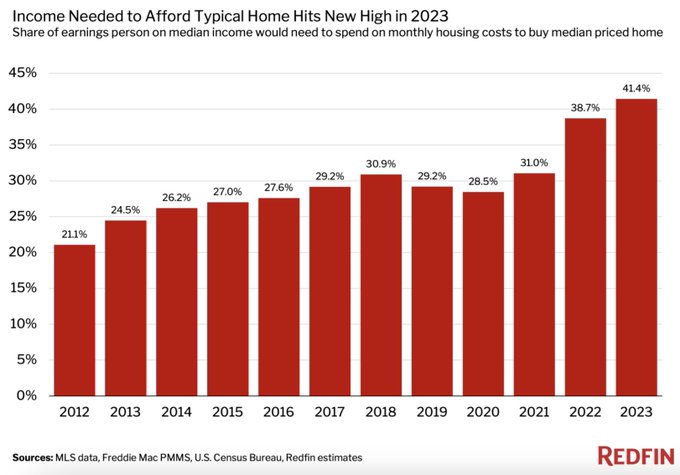

For this year, an individual earning the median income in the U.S. — $78,642 — would have needed to allocate over 40% of their income to monthly housing costs when purchasing a median-priced home, valued at around $400,000, as per Redfin's findings. This represents the highest percentage in Redfin's records dating back to 2012, indicating an almost 3% increase from the previous year.

unusual whales tweets:

quote:

At current rates, the average household could spend more than 60% of its monthly income on mortgage payments, assuming a 10% down payment, per Creditnews.

quote:

51% of Americans make a median annual salary of $75,000.

They can afford a home that costs about $256,000, per the National Association of Realtors.

Thhe median home price in the United States is $431,000, according to Federal Reserve Economic Data.

Posted on 12/20/23 at 9:05 am to GreatLakesTiger24

Biden made it illegal for millenials to own houses

Posted on 12/20/23 at 9:08 am to GreatLakesTiger24

Clearly the math hasn't worked for a while, this didn't just happen.

Don't buy houses you can't afford and that are over priced, and this current income to cost ratio wouldn't exist.

Don't buy houses you can't afford and that are over priced, and this current income to cost ratio wouldn't exist.

Posted on 12/20/23 at 9:09 am to GreatLakesTiger24

Banks qualified borrowers on a standard of 33% income to house monthly payment. Nowadays, they should raise that standard to at least 45% to help borrowers qualify.

Posted on 12/20/23 at 9:13 am to GreatLakesTiger24

quote:

The income needed to afford a typical home in the US hits a record 41.4% in 2023.

This is up from 21.1% in 2012 and 28.5% in 2020, according to Redfin.

On a POST-TAX basis, homebuyers are spending nearly 60% of their income on home payments.

A homebuyer would need to make at least $110,000 per year to spend 30% or less of their income on home payments.

Posted on 12/20/23 at 9:13 am to GreatLakesTiger24

First time home buyers should be buying below their income levels. That allows them to build up equity and stay within an appropriate % of their income. Once they build up equity, buying housing appropriate to their income level becomes more attainable, and eventually may be able to buy above their income level

Also using a median basis for income and comparing it to a median basis for home ownership doesn’t make sense. That assumes everyone should be able to buy a home - which is false, tons of people have to rent or choose to rent. That also assumes that people can only buy one home, also false. Tons of people in upper income brackets buy multiple houses. It’s just a poor and lazy comparison by some blogger

Also using a median basis for income and comparing it to a median basis for home ownership doesn’t make sense. That assumes everyone should be able to buy a home - which is false, tons of people have to rent or choose to rent. That also assumes that people can only buy one home, also false. Tons of people in upper income brackets buy multiple houses. It’s just a poor and lazy comparison by some blogger

This post was edited on 12/20/23 at 9:15 am

Posted on 12/20/23 at 9:14 am to GreatLakesTiger24

"Quit fricking whining all the time and make something of yourself. If you want to buy a house, work harder and gain more valuable skills. You only have yourself to blame if your life isn't going the way you want it to"

"This country is going down the toilet thanks to dems. Last one out hit the lights because we ain't coming back. Things were so much better and easier back in the day."

"This country is going down the toilet thanks to dems. Last one out hit the lights because we ain't coming back. Things were so much better and easier back in the day."

Posted on 12/20/23 at 9:16 am to GreatLakesTiger24

A large proportion of families now have duel incomes. It seems statistics are slanted to ignore. Although one may argue that an increasing number of households require at least 2 incomes just to stay above water.

Posted on 12/20/23 at 9:19 am to GreatLakesTiger24

People have to live somewhere, landlords generally make a profit or they don’t remain landlords.

Posted on 12/20/23 at 9:21 am to GreatLakesTiger24

A person making the median income and purchasing a median home is either 1) a moron and 2) keeping up with the Joneses.

Posted on 12/20/23 at 9:30 am to GreatLakesTiger24

If it doesn't work, I don't understand why housing prices haven't dropped then. If I'm selling my house for 300K and people can only afford 200K, then how am I selling my house for 300K? The market should make me lower my house price. What am I missing?

Posted on 12/20/23 at 9:32 am to GreatLakesTiger24

They don't even mention HOI.

Hell I bought my house for 220,000 about 7 years ago at about a 4% rate....today the amount going into my escrow for HOI/tax is way more that what is going to my premium...the total opposite of how it started in 2016.

So hell even if you make median income and you could afford the 200K-ish house....hell can you afford to insure it????

Thankfully I make way more than the median income and I'm not close to house poor even with the stupid insurance but I imagine a lot of people are.

Hell I bought my house for 220,000 about 7 years ago at about a 4% rate....today the amount going into my escrow for HOI/tax is way more that what is going to my premium...the total opposite of how it started in 2016.

So hell even if you make median income and you could afford the 200K-ish house....hell can you afford to insure it????

Thankfully I make way more than the median income and I'm not close to house poor even with the stupid insurance but I imagine a lot of people are.

Posted on 12/20/23 at 9:35 am to GreatLakesTiger24

With these prices and interest rates, I wouldn’t be able to afford my current home if i bought it today, and my income has gone up by about 30% since i bought it.

Posted on 12/20/23 at 9:42 am to GreatLakesTiger24

You will own nothing

And you will be happy

And you will be happy

Posted on 12/20/23 at 9:42 am to GreatLakesTiger24

I live in a county and city comprised of mostly upper middle class families with teens and retired people (also a LOT of military families who receive some serious housing stipends). It would be impossible anywhere in that county to buy a lot big enough for a well and septic tank, or one on county utilities, and build a modest home on it....the dirt is too damned expensive. It is too damned expensive in part due to demand but it also is a function of zoning that requires massive lots and restrictive covenants, allowed by zoning, which increase the costs of anything built in the county. About 95% of the development in the county in the last 20 years has consisted of tract house development with 4000 square foot, 5 bedroom 4 bath houses on 1/10th acre lots. A 1/4 acre lot is huge and a 1/2 acre lot looks like an estate. Those houses are selling for around $450K. Most of them have 3-5 people living in them. Those houses are what is required to make building lucrative enough to be worthwhile because of zoning and building codes that have nothing at all to do with owner safety and everything to do with keeping real estate prices as high as possible. There have been some proposals to build smaller houses, even condos and other attached residences...almost all BUT luxury condos have ever been approved. There is a market for smaller, less expensive moderate houses in the US and they can be built...but the margins are not attractive to developers and bankers and they control the market. This county is not unique, almost all of any area in the country close to jobs and services is identical. There is no way a family of 4 needs 4000 square feet of 5 br 4 bath house...but thats what is being built.

Posted on 12/20/23 at 9:55 am to GreatLakesTiger24

Dudes won’t buy what they can afford because she “needs” and open kitchen, walk in closet, play room for the kids and two washing machines. Gotta keep up.

Posted on 12/20/23 at 9:55 am to GreatLakesTiger24

It says "individual" income but that sure looks like median household income.

Posted on 12/20/23 at 10:08 am to GreatLakesTiger24

Don't buy a median home.

There is a large percentage of the population that rents.

This type of "oh my gawd" journalism is tiresome.

There is a large percentage of the population that rents.

This type of "oh my gawd" journalism is tiresome.

Posted on 12/20/23 at 10:26 am to GreatLakesTiger24

1. Marry a doctor's daughter

2. Get Paw in law to put down payment on house

3. ????

4. Profit/ Have house

2. Get Paw in law to put down payment on house

3. ????

4. Profit/ Have house

Posted on 12/20/23 at 10:59 am to GreatLakesTiger24

Your boy is over here with $165K in equity with a $1000 mortgage payment.

Popular

Back to top

44

44