- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

LiDAR stocks

Posted on 12/6/20 at 10:35 am

Posted on 12/6/20 at 10:35 am

This space is really starting to heat up. Keep a close eye on these:

LAZR - Luminar

Based out of Austin, these guys just went public via SPAC and quickly doubled in share price last week, valued at $8B+. They have all the buzz right now and carry the first mover advantage among this new breed of LiDAR tech companies.

IPV - Aeva (Going public via this SPAC in Q12021)

Valued at $2B+ and run by 2 former Apple guys. I think this could be the best long term play vs the others because they are also focusing on developing and moving their LiDAR tech to mobile devices.

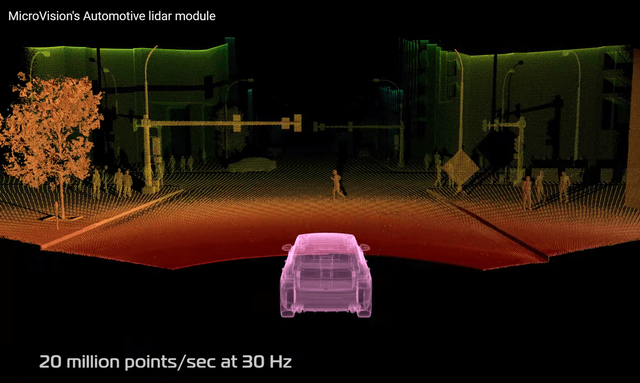

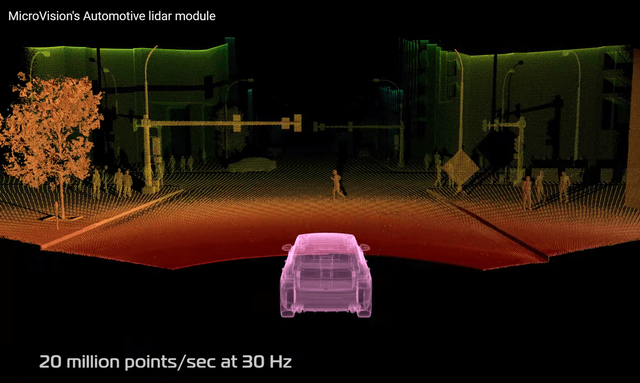

MVIS - MicroVision

I think this is the best short term play because they are 7 months into buyout negotiations and claim to have LiDAR tech that will best everyone. Mass production-ready sample set to be released in 4 months. They also recently added a new board of directors member with previous ties to Ford.

LAZR - Luminar

Based out of Austin, these guys just went public via SPAC and quickly doubled in share price last week, valued at $8B+. They have all the buzz right now and carry the first mover advantage among this new breed of LiDAR tech companies.

IPV - Aeva (Going public via this SPAC in Q12021)

Valued at $2B+ and run by 2 former Apple guys. I think this could be the best long term play vs the others because they are also focusing on developing and moving their LiDAR tech to mobile devices.

MVIS - MicroVision

I think this is the best short term play because they are 7 months into buyout negotiations and claim to have LiDAR tech that will best everyone. Mass production-ready sample set to be released in 4 months. They also recently added a new board of directors member with previous ties to Ford.

Posted on 12/6/20 at 10:44 am to ATLsuTiger

great info man appreciate you sharing the research.

do you have the SPAC ticker on the second one?

do you have the SPAC ticker on the second one?

This post was edited on 12/6/20 at 10:45 am

Posted on 12/6/20 at 10:50 am to cgrand

IPV is the SPAC for the Aeva merger.

Also look at Innoviz Technologies Ltd, they are rumored to be going public via SPAC as well, that one is CGRO.

Posted on 12/6/20 at 11:07 am to ATLsuTiger

I listened to Lex Fridman, MIT machine learning scientist, talk about LIDAR and I came away from his talk with the impression that cameras would be the future of EVs and that they were potentially much safer and accurate for self driving cars. This is just a total FYI here. I’m not saying these stocks can’t take off but he seemed to believe the Tesla and Google model of cameras would ultimately win out. A laser pointed out the side of the car only told you something was there. It could be roadkill that there is no need to slow down for or it could be a child where the car would need to break immediately. Only a camera could show you that.

Posted on 12/6/20 at 1:08 pm to PillPusher

Check out this Luminar patent:

United States Patent Application 20200300982 LaChapelle; Joseph September 24, 2020

COMBINING LIDAR AND CAMERA DATA

United States Patent Application 20200300982 LaChapelle; Joseph September 24, 2020

COMBINING LIDAR AND CAMERA DATA

Posted on 12/7/20 at 5:25 am to PillPusher

I don’t trust the technology and won’t until others use it a couple years to test drive it. I have no reservations against holding LAZR stock though.

Posted on 12/7/20 at 11:10 am to ATLsuTiger

If one is high on the future of this industry, is it a bad idea to buy a little of several of the players?

Posted on 12/7/20 at 11:54 am to turkish

quote:generally speaking, as I don't know the specifics here, no it is not a bad idea. It typically limits your upside and downside, however.

f one is high on the future of this industry, is it a bad idea to buy a little of several of the players?

Posted on 12/7/20 at 2:14 pm to ATLsuTiger

quote:

LAZR - Luminar

+32% today

Posted on 12/7/20 at 2:41 pm to cgrand

LiDAR is staying hot.

LAZR +34%

VLDR +22%

IPV +12%

CGRO +9%

MVIS +0%

The IPV ticker will eventually change to AEVA. I think this one could pull a LAZR type of move once the merger is finalized.

Aeva is using a unique approach to LiDAR(FMCW) that offers unique advantages over the competition. Plus like I said, other consumer applications are being targeted for their 4D LiDAR on Chip technology.

They are currently engaged with 30 companies, investors include Porsche and Audi, and they already have strategic partners in place for 2024 production.

The ties to Apple won't hurt either.

LAZR +34%

VLDR +22%

IPV +12%

CGRO +9%

MVIS +0%

The IPV ticker will eventually change to AEVA. I think this one could pull a LAZR type of move once the merger is finalized.

Aeva is using a unique approach to LiDAR(FMCW) that offers unique advantages over the competition. Plus like I said, other consumer applications are being targeted for their 4D LiDAR on Chip technology.

They are currently engaged with 30 companies, investors include Porsche and Audi, and they already have strategic partners in place for 2024 production.

The ties to Apple won't hurt either.

Posted on 12/7/20 at 2:46 pm to turkish

The LiDAR race is just starting so it's hard to tell who will come out on top. Grabbing a piece of several is probably the best way to play it.

Posted on 12/8/20 at 1:19 am to ATLsuTiger

I like IPV the best for 2 reasons. Apple guys and they want to use it for any tech possible that might need it. Not just cars or phones.

Not that Apple makes them the best. The younger investors love their brand names. Seems like they throw company fundamentals out the window. Fine with me, I'll take the hot ride and get out when it tanks, if it does.

Not that Apple makes them the best. The younger investors love their brand names. Seems like they throw company fundamentals out the window. Fine with me, I'll take the hot ride and get out when it tanks, if it does.

Posted on 12/8/20 at 8:10 pm to ReadyPlayer1

Started a decent position in IPV today. Just realized I sold GMHI (LAZR) @ $11.30/share in september.. damnit

Posted on 12/9/20 at 12:44 am to reds on reds on reds

I passed on pre/qs ( forgot the ticker) when it was at 14 or so. Thought they were overselling what they really have.

Wish I had enough money to spread out on all the spacs I like when they are at $10. I feel like most don't go below that.

Wish I had enough money to spread out on all the spacs I like when they are at $10. I feel like most don't go below that.

This post was edited on 12/9/20 at 12:51 am

Posted on 12/9/20 at 8:35 am to ATLsuTiger

Exciting wave of the future stuff. I've done a bunch of motion tracking in the past. There are some very tricky things in getting a good track, and doing so in real time with life and death in the bargain is awe inspiring.

Hard to know who the winner will be in this still infant industry.

Hard to know who the winner will be in this still infant industry.

Posted on 12/11/20 at 9:18 am to Auburn1968

Lidar startup Innoviz goes public via $1.4 billion SPAC merger

Venturebeat.com

quote:

Israeli lidar startup Innoviz Technologies today announced that it will become publicly listed through a special-purpose acquisition company (SPAC) merger, where a “blank check” shell corporation — Collective Growth Corporation — will take it public without going through the traditional IPO process. Innoviz says the cash-and-stock transaction values it at $1.4 billion, and it’s expected to be listed on the Nasdaq under the ticker symbol “INVZ.”

Venturebeat.com

Posted on 12/11/20 at 10:10 am to jimjackandjose

CGRO will become INVZ

Posted on 12/11/20 at 10:31 am to ATLsuTiger

All these startup LiDAR companies now have billion+ dollar valuations attached. All except for Microvision, who is still trading under $3/share ($400m market cap) while in the middle of buyout negotiations.

Their MEMS scanning mirror technology also powers augmented reality displays like Microsoft's Hololens 2 and the US Army's IVAS.

They offer 20m data cloud points per second in their LiDAR sensor being released in April, which appears to be more than LAZR's(estimated closer to 10 million).

There are several options to play the LiDAR sector right now, but again, I just think MVIS is easily the best value for your investment dollars.

Their MEMS scanning mirror technology also powers augmented reality displays like Microsoft's Hololens 2 and the US Army's IVAS.

They offer 20m data cloud points per second in their LiDAR sensor being released in April, which appears to be more than LAZR's(estimated closer to 10 million).

There are several options to play the LiDAR sector right now, but again, I just think MVIS is easily the best value for your investment dollars.

Posted on 12/11/20 at 12:07 pm to ATLsuTiger

Any opinion on why LAZR has taken a butt whipping over the past few days?

Popular

Back to top

6

6