- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: The social security tax cap is going to be lifted before 2033.

Posted on 4/19/25 at 12:19 pm to VABuckeye

Posted on 4/19/25 at 12:19 pm to VABuckeye

Lifting the cap would raise taxes on:

1) approx 15% of Californians

2) approx 11% of Georgians

3) approx 11% of Texans

4) approx 18% of New England wage earners

That’s a lot of people.

1) approx 15% of Californians

2) approx 11% of Georgians

3) approx 11% of Texans

4) approx 18% of New England wage earners

That’s a lot of people.

Posted on 4/19/25 at 12:21 pm to HailHailtoMichigan!

And it wouldn’t be progressive. It’s just a 13% flat increase on those earners for all income over the current limit

This post was edited on 4/19/25 at 12:22 pm

Posted on 4/19/25 at 12:39 pm to Mingo Was His NameO

The alternative is hordes of retired boomers flooding to the polls to protest the 17% benefit cuts that would happen in 2033.

It’s such an awful situation all around. I am dreading the 2030s for this reason.

It’s such an awful situation all around. I am dreading the 2030s for this reason.

Posted on 4/19/25 at 1:30 pm to HailHailtoMichigan!

It is natural for all of us to think about our individual situations. I'd like to think about a small to moderate size company that has a significant percentage of high wage earners. That company's tax burden might become onerous very quickly.

Posted on 4/19/25 at 1:55 pm to HailHailtoMichigan!

quote:

The social security tax cap is going to be lifted before 2033

Seems like I need to retire within 8 years. That's a major tax hike.

FWIW they would get massively closer to making social security solvent if they stopped raiding it to fund disability. Funding disability was never an intended use of social security. It wasn't in legislation, that was just a judge's ruling that hasn't been overturned

Posted on 4/19/25 at 2:38 pm to HailHailtoMichigan!

quote:

all wages above 168k will face the 12.4% tax increase

Won't the employer continue to carry half of that tax burden (6.2%)?

Posted on 4/19/25 at 4:48 pm to VABuckeye

Technically, but economic research indicates that the incidence of the employer portion falls on the employee in the form of reduced wages.

It’s not unlike how technically, tariffs are paid by us companies, but in reality consumers pay it via higher prices

It’s not unlike how technically, tariffs are paid by us companies, but in reality consumers pay it via higher prices

Posted on 4/19/25 at 6:52 pm to HailHailtoMichigan!

As someone who was an employer for 25 years I disagree.

Posted on 4/19/25 at 7:58 pm to HailHailtoMichigan!

... or we could just take the billions being run through USAID to fund leftist NGO's and CIA color revolutions in other countries, and give it back to the American people whence it came.

Posted on 4/19/25 at 8:53 pm to NC_Tigah

quote:

Then every one of them will get thrown out on their ear ... deservedly. Plus I'm not sure such stupidity could withstand the inherent legal challenges.

So what’s your solution?

Posted on 4/19/25 at 11:09 pm to LSUFanHouston

quote:

So what’s your solution?

1 Eliminate disability funding

2 Allow DOGE (or an equivalent auditor) to root through the organization and eliminate more fraud and waste

3. If those aren't enough only then adjust upwards the age at which benefits can be collected to match the SS revenues collected

There's just not room in the budget for additional deficit spending. Annual payments on interest exceed military spending. 37 Trillion is a civilization destroying number.

If you don't restrict spending now there will be a lowered QOL and standard of living for 99% of the population

Posted on 4/19/25 at 11:11 pm to VABuckeye

quote:

As someone who was an employer for 25 years I disagree.

agreed. nice to get the tax break on the back end but we have to pay it up front via payroll tax.

Posted on 4/20/25 at 12:33 pm to Rize

quote:

or at least be able to have an easy job working at a gun store.

I kind of think I'd enjoy that too if I'm able to retire early. Maybe work part time to give me something to do.

Posted on 4/20/25 at 1:06 pm to molsusports

quote:

Funding disability was never an intended use of social security. It wasn't in legislation, that was just a judge's ruling that hasn't been overturned

What case are you referring to? I've never heard this before so looked it up and read SS disability was inacted with the Social Security Amendments of 1956 signed into law by Eisenhower.

According to this SSA.article about the disability program history, it was left out of the original law but was a topic of debate during development and early years of SS. Social Security and the "D" in OASDI: The History of a Federal Program Insuring Earners Against Disability

This post was edited on 4/20/25 at 1:08 pm

Posted on 4/20/25 at 1:20 pm to LSUFanHouston

quote:My solution? My solution would be to privatize the thing, with an opt out given demonstrated competency.

So what’s your solution?

But that's neither here nor there, because at our debt levels, the government desperately needs the guaranteed lending pool SS provides. So SS won't be privatized. It will be grown, likely with an increase in payroll tax contribution from 12.4% to about 15%. That's obviously not my solution, but it's what will happen.

Posted on 4/20/25 at 1:42 pm to NC_Tigah

"I can't let the man continue with fuzzy math!"

Posted on 4/20/25 at 1:42 pm to NC_Tigah

I think they'll raise the income limit first. "Sticking it to the rich" is much more politically popular than a tax increase on the middle class. It won't be enough to fix it though.

Posted on 4/20/25 at 2:24 pm to fallguy_1978

quote:Then they'd either have to commit to far larger payouts (> pay-in = > payout) or completely disjoin those select accounts from their inherent Debt Obligations, which creates a 14th Amendment problem.

I think they'll raise the income limit first. "Sticking it to the rich" is much more politically popular than a tax increase on the middle class.

Posted on 4/20/25 at 5:33 pm to NC_Tigah

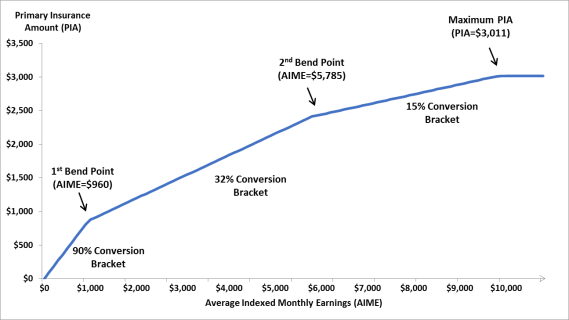

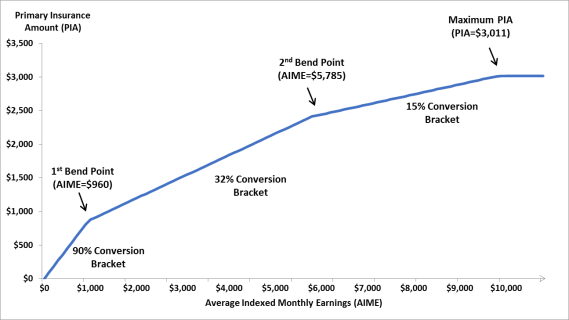

SS already gives diminishing returns as earnings/contributions increase. They could just extend the 15% bend point or add another even lower percentage one. I doubt it's a constitutional hurdle.

Average Indexed Monthly Earnings (AIME):

Your AIME is the average of your highest 35 years of earnings, adjusted for inflation.

90% of the first $1,226 of AIME is calculated.

32% of the AIME between $1,226 and $7,391 is calculated.

15% of the AIME above $7,391 is calculated.

This chart is a few years old but same concept

Average Indexed Monthly Earnings (AIME):

Your AIME is the average of your highest 35 years of earnings, adjusted for inflation.

90% of the first $1,226 of AIME is calculated.

32% of the AIME between $1,226 and $7,391 is calculated.

15% of the AIME above $7,391 is calculated.

This chart is a few years old but same concept

Posted on 4/21/25 at 10:22 am to bigjoe1

quote:

Congress will have to grow a set and raise the retirement age and probably means test.

So I would have to pay the max every year and once I retire I would make too much money to draw from it? That’s literally theft and is complete bullshite.

This post was edited on 4/21/25 at 10:27 am

Popular

Back to top

1

1