- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

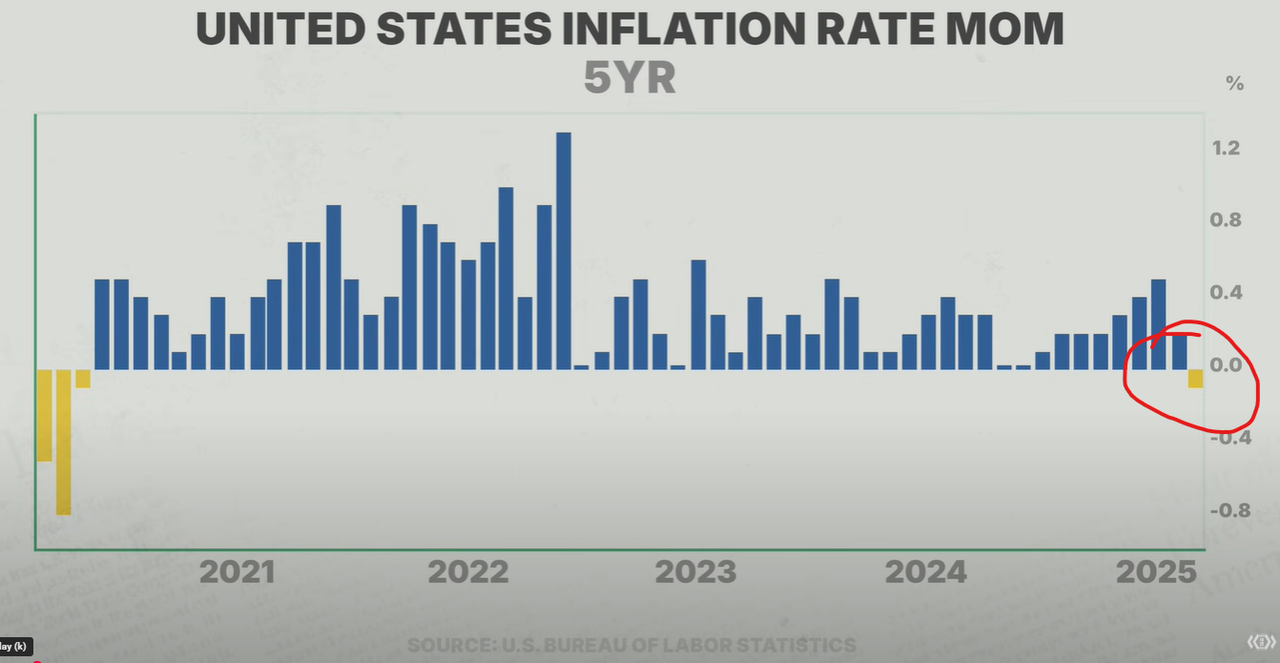

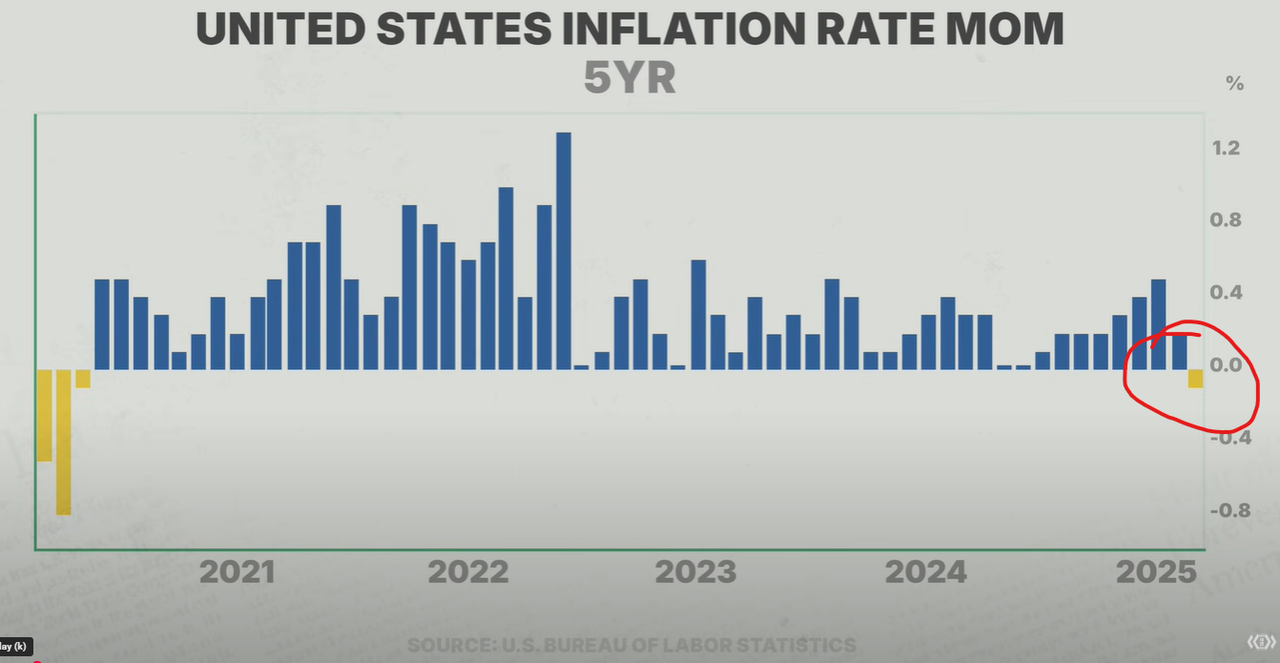

Deflation is Here Again for the First Time Since 2020

Posted on 4/17/25 at 8:02 am

Posted on 4/17/25 at 8:02 am

If the trend continues the Federal Reserve will have to cut. "Inflation" is a key metric the FR tracks to set the Fed's Fund Rate.

Posted on 4/17/25 at 8:06 am to GumboPot

I'm ready for cheaper stuff.

Posted on 4/17/25 at 8:06 am to GumboPot

quote:

the trend continues the Federal Reserve will have to cut.

They are behind on the cuts like always Too Late Jerome needs to stop playing politics. Me and Trump are right again

Posted on 4/17/25 at 8:09 am to SDVTiger

quote:

They are behind on the cuts like always Too Late Jerome needs to stop playing politics. Me and Trump are right again

The FR is always a quarter behind, which is fine by me. I guess they want to see deflating CPI numbers with higher unemployment before they act.

Posted on 4/17/25 at 8:40 am to GumboPot

I was told tariffs would cause massive inflation

Posted on 4/17/25 at 8:41 am to RougeDawg

quote:

I'm ready for cheaper stuff.

You're going waiting a long time. Trump tariffs are fixing to make prices soar.

Posted on 4/17/25 at 8:43 am to GumboPot

or powell is UNIPARTY and desperately want's trump to fail.

i'm not complaining thanks to his propping up joe biden i've got a 2.5% 15 year mortgage!

i'm not complaining thanks to his propping up joe biden i've got a 2.5% 15 year mortgage!

Posted on 4/17/25 at 8:47 am to GumboPot

Trump is such a shite head. Every time he gets in office we get this deflation. He can’t keep giving us a cheaper cost of living and getting away with it.

Posted on 4/17/25 at 9:59 am to GumboPot

quote:

If the trend continues the Federal Reserve will have to cut. "Inflation" is a key metric the FR tracks to set the Fed's Fund Rate.

While the Fed has continued to slowly divest itself of COVID assets, M1 and M2 have been moving back upward for at least the last year. Normally this would be a sign of growing liquidity, but when you bring in wage growth, inflation and consumer debt (car loans, credit card debt and underscored by personal savings as a percentage of disposable income), it shows consumers are still trying to offset inflation through debt.

When we start looking at credit card delinquencies (90+ days), we see a steady climb from ~8% in Q2 2023 to Q4 2024's 11.35%, with expectations for Q1 2025 being ~ 11.5%. Next, we can look at approximate vehicle repossession rates:

2007: ~1.9 million (approximated from Cox Automotive chart trends)

2008: ~2.0 million (Great Recession peak)

2009: ~1.9 million (high due to financial crisis)

2010–2016: ~1.6–1.8 million (gradual decline post-recession)

2017: ~1.8 million

2019: 1.68 million

2020: ~1.3 million (COVID-era drop)

2021: ~1.1 million (COVID low due to stimmy checks, PPP, etc)

2022: ~1.2 million

2023: ~1.5 million

2024: ~1.73 million

2025: It's too early to tell but at this point it's likely to be ~1.75–2 million

What this all means, at least the way that I read it, is that we're in the early part of the consumer debt bubble popping. Right now the Fed's choices are:

1. Lower rates and kick inflation back up near 3% again. Real wages remaining flat means more consumer debt creation and continued growth in loan delinquencies. The Fed isn't likely to make large cuts, meaning the rise in delinquency/default risks for the credit card companies will cause card rates to go higher (most sites have the current average ranging from ~22%-28%) rather than follow the Fed's path. This feeds the debt bubble popping both through the return of the slow crawl of upward inflation as well as loan rate increases.

2. Raise rates and fast-track the recession and subsequent consumer debt bubble popping. This is the absolute least likely scenario.

3. Keep rates the same, causing inflation to continue to move downward. With jobless claims (both new and continued) slowly going down, this SHOULD indicate job growth and if that's the case then keeping rates stagnant would keep those trends going. This would stretch the debt popping bubble out a bit, at least if Unemployment and real wages remain stagnant (ideally real wages would increase as inflation drops).

Remember, you raise rates when the economy is good, you cut rates when the economy is bad. With so much of GDP growth being carried by increasing consumer debt, keeping rates stagnant seems to be the least shitty option at least until we see Unemployment start moving above 4.5-5%.

Posted on 4/17/25 at 12:04 pm to Bard

Bump for the man, the myth, the self claimed legend Roger to see.

Popular

Back to top

5

5