- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Luntz is stunned by these Trump voters on the stock market 'crash'

Posted on 4/26/25 at 8:34 pm

Posted on 4/26/25 at 8:34 pm

'Never Trumper' Frank Luntz asks a group about the stock market, how Trump 'has crashed your 401k's, most of yous, from the tariffs'

Indexed to this point of the video...

Indexed to this point of the video...

Posted on 4/26/25 at 9:57 pm to captainFid

Is he gonna stroke out again over Trump?

Posted on 4/26/25 at 10:34 pm to captainFid

I've always thought this.

First, the average American does not have a very big stock portfolio to begin with. Stocks are heavily weighted to the top 20% of net worth in the country.

Second, the Americans that do have big enough portfolios to feel an impact have enough brains to know this was a temporary dip and not something to panic over like a true collapse.

The media class has been trying to hype the tariff dip and it's just not sticking. It's beautiful.

First, the average American does not have a very big stock portfolio to begin with. Stocks are heavily weighted to the top 20% of net worth in the country.

Second, the Americans that do have big enough portfolios to feel an impact have enough brains to know this was a temporary dip and not something to panic over like a true collapse.

The media class has been trying to hype the tariff dip and it's just not sticking. It's beautiful.

Posted on 4/26/25 at 10:41 pm to captainFid

We have seen this focus group play out on this board. We have Bunk, SeldomSenile, Roger, SfP, etc., playing the role of Frank Luntz daily.

Posted on 4/26/25 at 10:49 pm to captainFid

I am buying every S&P share that I can squeeze out money to buy right now. This is a great opportunity and everyone should take advantage of it

Posted on 4/27/25 at 1:04 am to captainFid

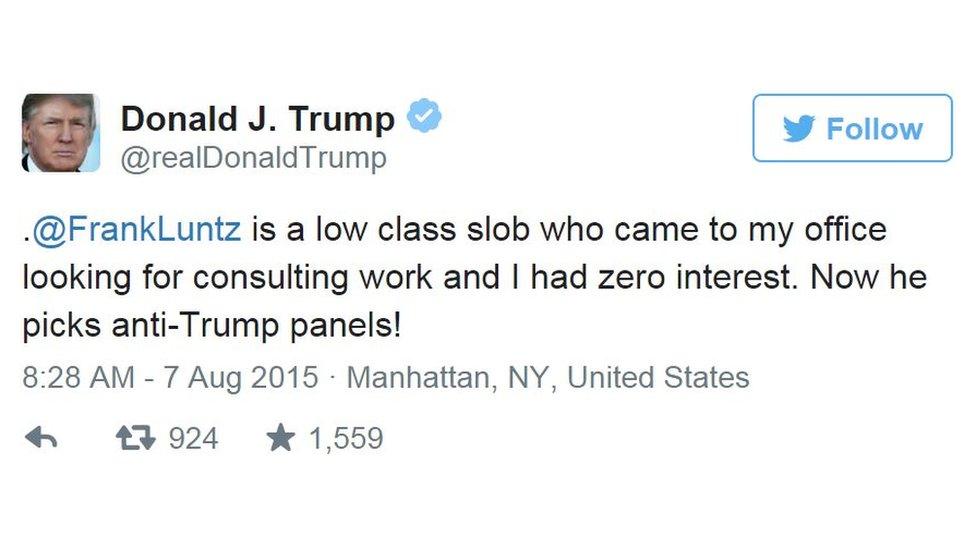

Isn't Luntz the same dude that was pretty much guaranteeing a Kamala victory about a month prior to the election?

Posted on 4/27/25 at 2:42 am to captainFid

Like most tubs of goo these days, Frank has grown a beard to hide his fat.

Posted on 4/27/25 at 3:36 am to captainFid

They so badly want to portray this as October of 1929

But it isn’t

But it isn’t

Posted on 4/27/25 at 6:54 am to captainFid

Never ask questions you don't know the answer to especially in a large group assembled like that. Ameteur!

Posted on 4/27/25 at 6:59 am to captainFid

If Luntz wants credibility at polling, he really should stick to unbiased questions. When he did not get the answer he expected (or wanted), he phrased the questions in a "gotcha form", but it still didn't work.

Posted on 4/27/25 at 7:05 am to captainFid

LakeSoy7 wants everyone to be mad about the economy crashing

He pretends to have a big portfolio like all the money board clowns

He pretends to have a big portfolio like all the money board clowns

Posted on 4/27/25 at 7:10 am to captainFid

no one in there 30s 40s or 50s should care about a crash that will ultimately bounce back.

Posted on 4/27/25 at 7:14 am to captainFid

Love this dude’s podcasts! It’s been fascinating watching his subscription numbers over the past year - he’s blowing up!

“Boy oh boy oh boy oh boy - okaaaay!”

“Boy oh boy oh boy oh boy - okaaaay!”

Posted on 4/27/25 at 7:29 am to captainFid

Serious question, has anyone seen Roger on here? I have been pretty busy the last several days so not a lot of time on here, but what time I have been on here, I haven't seen him in any thread?

Asking seriously. I'm afraid he may be back in rehab, or worse. He was losing it pretty bad here not long ago and with his history.....

Asking seriously. I'm afraid he may be back in rehab, or worse. He was losing it pretty bad here not long ago and with his history.....

Posted on 4/27/25 at 7:31 am to Big4SALTbro

early 50s maybe, depending on when you gonna retire. I'm late 50s and wanting to work til around 65. I'm already pulling out of higher risk stocks/funds, not entirely, but my mix is much more conservative now.

Posted on 4/27/25 at 7:55 am to Mandtgr47

quote:

has anyone seen Roger on here?

Probably out keying Teslas for fun.

Posted on 4/27/25 at 8:10 am to Thundercles

quote:

First, the average American does not have a very big stock portfolio to begin with. Stocks are heavily weighted to the top 20% of net worth in the country.

The average American has no idea what the specific holdings in their 401(k) are. Most retirement accounts that aren’t self managed are invested in equities themselves or mutual funds, index funds or ETF’s that are predominantly invested in equities.

Posted on 4/27/25 at 9:27 am to Thundercles

quote:spot on summary. All points

I've always thought this.

First, the average American does not have a very big stock portfolio to begin with. Stocks are heavily weighted to the top 20% of net worth in the country.

Second, the Americans that do have big enough portfolios to feel an impact have enough brains to know this was a temporary dip and not something to panic over like a true collapse.

The media class has been trying to hype the tariff dip and it's just not sticking. It's beautiful.

Posted on 4/27/25 at 9:50 am to Thundercles

quote:

Second, the Americans that do have big enough portfolios to feel an impact have enough brains to know this was a temporary dip and not something to panic over like a true collapse.

I know it's heresy to say this, but fixing the US economy will most likely entail a collapse of the stock market, in inflation adjusted terms at the minimum. Even though the S&P 500 has been steadily rising for decades with only short sharp pullbacks, if we ever do what it takes to reduce debt fueled consumption, that will change

Posted on 4/27/25 at 9:58 am to captainFid

That was an excellent comment by the guy mentioning price elasticity. I vaguely remember the concept from one of my economic courses but to refresh here's the definition:

Price Elasticity of Demand (PED):

Formula: PED = (% Change in Quantity Demanded) / (% Change in Price)

Elastic (PED > 1): Demand is sensitive to price changes (e.g., luxury goods like designer clothes). A small price increase leads to a large drop in demand.

Inelastic (PED < 1): Demand is less sensitive (e.g., necessities like medicine). Price changes have little impact on quantity demanded.

Unit Elastic (PED = 1): Percentage change in demand equals percentage change in price.

Factors affecting PED:

Substitutes: More substitutes make demand more elastic.

Necessity vs. luxury: Necessities are inelastic; luxuries are elastic.

Time: Demand is more elastic in the long run as consumers adjust.

Proportion of income: Goods taking a large share of income are more elastic.

It terms of tariff policy it appears Trump is putting a lot of pressure on elastic goods from China (minus steel and aluminum) and relieving price pressure on inelastic goods like oil. With more money to spend because of saving on energy (inelastic goods) people will be okay with purchasing elastic good substitutes.

Price Elasticity of Demand (PED):

Formula: PED = (% Change in Quantity Demanded) / (% Change in Price)

Elastic (PED > 1): Demand is sensitive to price changes (e.g., luxury goods like designer clothes). A small price increase leads to a large drop in demand.

Inelastic (PED < 1): Demand is less sensitive (e.g., necessities like medicine). Price changes have little impact on quantity demanded.

Unit Elastic (PED = 1): Percentage change in demand equals percentage change in price.

Factors affecting PED:

Substitutes: More substitutes make demand more elastic.

Necessity vs. luxury: Necessities are inelastic; luxuries are elastic.

Time: Demand is more elastic in the long run as consumers adjust.

Proportion of income: Goods taking a large share of income are more elastic.

It terms of tariff policy it appears Trump is putting a lot of pressure on elastic goods from China (minus steel and aluminum) and relieving price pressure on inelastic goods like oil. With more money to spend because of saving on energy (inelastic goods) people will be okay with purchasing elastic good substitutes.

Popular

Back to top

16

16