- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Silver Stocks or possibly ETF

Posted on 6/12/21 at 8:56 pm

Posted on 6/12/21 at 8:56 pm

Someone went through these a long time ago.

What are some good silver stocks? I believe it went on a good run last year, and with inflation getting worse, this seems like it would be a good play. What say you?

I’m seeing AG, WPM, SLV on a Motley Fool page I saw on search

What are some good silver stocks? I believe it went on a good run last year, and with inflation getting worse, this seems like it would be a good play. What say you?

I’m seeing AG, WPM, SLV on a Motley Fool page I saw on search

This post was edited on 6/12/21 at 8:59 pm

Posted on 6/12/21 at 9:13 pm to xxTIMMYxx

Paper silver is a scam. It’s heavily manipulated by JPM and other banks. There will not be a short squeeze and the price will not see a large move. You might make some gains, but nothing serious

Posted on 6/12/21 at 9:17 pm to Upperdecker

Physical is the way to go.

Do you think Physical will go up in value or do the ETFs hold it back?

Do you think Physical will go up in value or do the ETFs hold it back?

Posted on 6/12/21 at 9:28 pm to Upperdecker

This… Don’t get into Silver right now. It’s an industrial metal that’s produced in near infinite quantities in Mexico and elsewhere. Any increase in price will only encourage more mining to offset the increases in price with excess supply.

If you are gonna do it; own physical. Right now Silver premiums are way too high.

There’s a doomsday prepper or a Silverbug who’s gonna downvote me. They’re convinced that by 2022 you’ll be able to exchange physical silver shavings circa 1863 and/or Bitcoin for goods and services.

If you are gonna do it; own physical. Right now Silver premiums are way too high.

There’s a doomsday prepper or a Silverbug who’s gonna downvote me. They’re convinced that by 2022 you’ll be able to exchange physical silver shavings circa 1863 and/or Bitcoin for goods and services.

This post was edited on 6/12/21 at 10:28 pm

Posted on 6/12/21 at 10:10 pm to xxTIMMYxx

PSLV is the best ETF do not buy SLV. Regarding miners my favorites are HL, CDE, ABRRF, and AG. Silver has been stuck in a trading channel between $27-28 for the last few weeks, my opinion is once the July options come off the board next week we will break through $28 and push to the next resistance level of $30 which has been a major resistance barrier in the past.

If you want to further investigate junior silver miners google Gold ventures sitfolio, he ranks the best junior miners from 1-30 and has an excellent return track record. Or you can just be lazy and buy the SILJ ETF

If you want to further investigate junior silver miners google Gold ventures sitfolio, he ranks the best junior miners from 1-30 and has an excellent return track record. Or you can just be lazy and buy the SILJ ETF

Posted on 6/12/21 at 10:34 pm to wiltznucs

quote:

This… Don’t get into Silver right now. It’s an industrial metal that’s produced in near infinite quantities in Mexico and elsewhere. Any increase in price will only encourage more mining to offset the increases in price with excess supply.

If you are gonna do it; own physical. Right now Silver premiums are way too high.

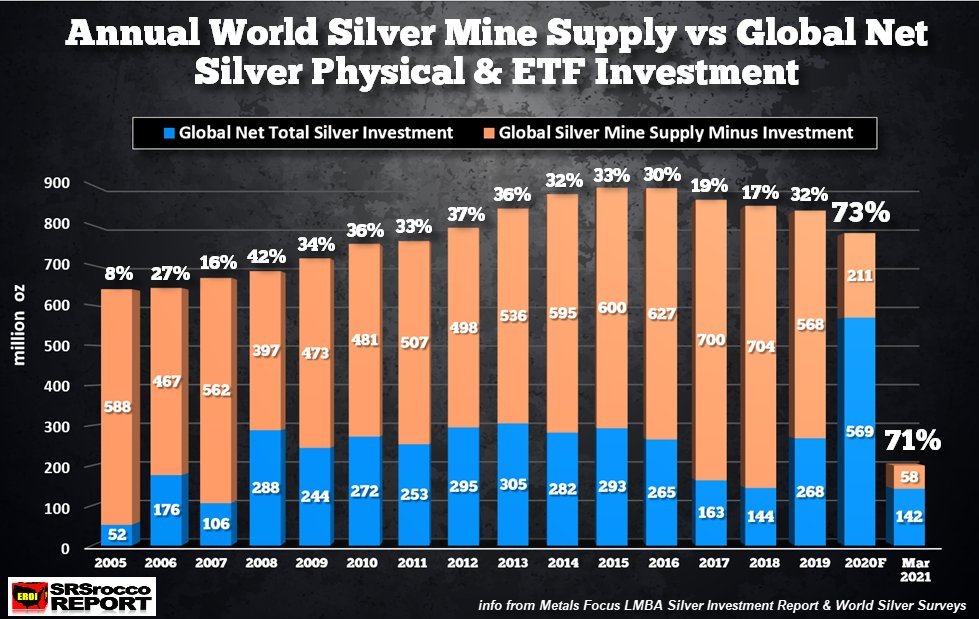

This is not true at all. Mining supply has decreased every year for the past 5 years while industrial demand has increased 10% every year and investment demand significantly more than that.

Silver is typically mined as a result of mining for other metals, usually as a by-product of mining for lithium/gold/copper. A decade long silver bear market has resulted in lower R&D and exploration for new mines so there will be quite a delay in increasing supply if they need it.

Posted on 6/13/21 at 6:24 am to FredsGotSlacks

Alright, cool. HAd a coworker bring it up.

I, personally bought some etherium this morning around 2300. Will add more if it continues to drop like every weekend for the last month

I, personally bought some etherium this morning around 2300. Will add more if it continues to drop like every weekend for the last month

This post was edited on 6/13/21 at 6:26 am

Posted on 6/13/21 at 6:27 am to xxTIMMYxx

I did just recently hear a guy on tv say that the supply of silver is running quite low. Have no idea how true that is. Lots of demand, low supply essentially

This post was edited on 6/13/21 at 6:28 am

Posted on 6/13/21 at 6:30 am to xxTIMMYxx

quote:

I did just recently hear a guy on tv say that the supply of silver is running quite low. Have no idea how true that is. Lots of demand, low supply essentially

People have been saying this for a full year now. It’s been thoroughly discussed here. You might make money with a miner, but the price of paper silver won’t increase significantly. SLV is incredibly manipulated

Posted on 6/13/21 at 6:31 am to Upperdecker

I wasn’t serious about this. Will probably forward any info to my coworker

Posted on 6/13/21 at 10:17 am to xxTIMMYxx

So, crypto it is. Somewhat decent prices this morning

Posted on 6/13/21 at 11:01 am to xxTIMMYxx

SIL and SILJ seniors and juniors. Welcome to this torturous market

Posted on 6/13/21 at 11:08 am to xxTIMMYxx

quote:

believe it went on a good run last year, and with inflation getting worse, this seems like it would be a good play.

Physical metals have been a woeful inflation hedge over time. They’re a fear hedge, at best.

Posted on 6/13/21 at 1:04 pm to slackster

- 4.2% average return per year since 2011. Silver Sucks and is junk.

Posted on 6/13/21 at 2:15 pm to PUB

quote:

- 4.2% average return per year since 2011. Silver Sucks and is junk.

Any particular reason you chose 2011? Maybe because that’s the high point of silver prices over the past 40 years. With that line of thinking You can look at any investment and if it isn’t at its historical high its a bad investment. Silver is up 60% from the bottom of the bear run last year and still has a lot of run left considering most market experts are predicting prices to far exceed the 2011 high.

Don’t listen to all the crypto bro’s that love to bash it, they have an inferiority complex when it comes to precious metals for some reason

Posted on 6/13/21 at 3:29 pm to FredsGotSlacks

Check out CEF. Holds physical silver and gold mostly silver. I don't own it now but I did for several years.

Posted on 6/13/21 at 5:09 pm to xxTIMMYxx

Do not buy SLV. Big scam.

PSLV is the best non-physical version.

PSLV is the best non-physical version.

Posted on 6/13/21 at 6:53 pm to FredsGotSlacks

Go back > 40 years to the last big pump.

Silver pumps up every 20 to 40 years then dumps and never moves. One of worse investments of the past decade. Starting DOWN AGAIN this week.

It is an industrial metal only and no longer hold any value as a monetary currency. Doge coin has greater value as a currency right now than silver. And that is a scam coin.

Just IMO but Wall Street Silver could have a billion followers and it is not going to the moon.

Silver pumps up every 20 to 40 years then dumps and never moves. One of worse investments of the past decade. Starting DOWN AGAIN this week.

It is an industrial metal only and no longer hold any value as a monetary currency. Doge coin has greater value as a currency right now than silver. And that is a scam coin.

Just IMO but Wall Street Silver could have a billion followers and it is not going to the moon.

This post was edited on 6/13/21 at 6:56 pm

Posted on 6/13/21 at 7:37 pm to PUB

Physical metals serve a wholly different purpose and need than crypto.

One is analog, and serves to hedge against a government mismanagement of a nation’s fiat currency ..... of which ample evidence is readily available to all that wish to see ....

and the other is a digital transaction medium built on a secure blockchain technology and is highly speculative, and easily tracked by the federal government.

They each serve different purposes in a portfolio, and both should be considered. If you don’t understand why an analog metal should be considered valuable, look no further than the current sweeping efforts by the Biden Administration to significantly increase the inheritance tax, along with related measures to enforce it’s collection.

Forewarned is forearmed.....

I would agree with those that rail against “paper” metals .... and their very obvious manipulation. The reddit crew was schooled when it attempted to squeeze the silver market .... and deservedly so ..... their attemp was laughable, IMO.

That said, to answer the OP’s question, the metal-backed funds offered by Sprott (PSLV, PHYS, and CEF) are excellent methods to invest in metals while avoiding the currently-high premiums on physical sold by typical retail dealers (created by strong worldwide demand). The Sprott funds are back by physical holdings, which sets them apart from many other funds.

Spot silver will likely surpass $45/oz during the next 3 quarters ......and the GSR will likely drop below 50:1 for the first time in a meaningful period of time .....(it was above 110:1 as recent as a year ago.)

If you’re considering investing in miners, they can be very profitable, but IMO the junior miners (GDXJ) are significantly more risky today than they were a year ago .... stick to the majors (GDX and individual operators) in the near-term/mid-term. I like AR and KGC in this space. But to me, MTA offers the best exposure while limiting risks, however, be aware of the tax implications before investing in MTA.

FredsGotSlack’s post above offers good insight on why metals commodities are expected to rise in the mid-term ..... good fortunes

One is analog, and serves to hedge against a government mismanagement of a nation’s fiat currency ..... of which ample evidence is readily available to all that wish to see ....

and the other is a digital transaction medium built on a secure blockchain technology and is highly speculative, and easily tracked by the federal government.

They each serve different purposes in a portfolio, and both should be considered. If you don’t understand why an analog metal should be considered valuable, look no further than the current sweeping efforts by the Biden Administration to significantly increase the inheritance tax, along with related measures to enforce it’s collection.

Forewarned is forearmed.....

I would agree with those that rail against “paper” metals .... and their very obvious manipulation. The reddit crew was schooled when it attempted to squeeze the silver market .... and deservedly so ..... their attemp was laughable, IMO.

That said, to answer the OP’s question, the metal-backed funds offered by Sprott (PSLV, PHYS, and CEF) are excellent methods to invest in metals while avoiding the currently-high premiums on physical sold by typical retail dealers (created by strong worldwide demand). The Sprott funds are back by physical holdings, which sets them apart from many other funds.

Spot silver will likely surpass $45/oz during the next 3 quarters ......and the GSR will likely drop below 50:1 for the first time in a meaningful period of time .....(it was above 110:1 as recent as a year ago.)

If you’re considering investing in miners, they can be very profitable, but IMO the junior miners (GDXJ) are significantly more risky today than they were a year ago .... stick to the majors (GDX and individual operators) in the near-term/mid-term. I like AR and KGC in this space. But to me, MTA offers the best exposure while limiting risks, however, be aware of the tax implications before investing in MTA.

FredsGotSlack’s post above offers good insight on why metals commodities are expected to rise in the mid-term ..... good fortunes

This post was edited on 6/13/21 at 8:03 pm

Posted on 6/13/21 at 7:59 pm to cadillacattack

Hope you are correct on the $45 and GSR but I will believe it when I see it. And going to dump big time if it ever happens. Been Nothing but dead $$ and wasted space

Popular

Back to top

5

5