- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

WSJ Piece: Young Americans Are Getting Left Behind by Rising Home Prices, Higher Stocks

Posted on 4/27/24 at 8:25 am

Posted on 4/27/24 at 8:25 am

quote:

Just married and with a newborn son, Anthony and Caitlin Fumo expected their well-paying jobs and chunk of savings to support a move closer to their parents in the suburbs of New Jersey.

But leaving their 1,000-square-foot Philadelphia rowhome means borrowing with rates around 7%—to buy in a market where the typical home value has jumped 40% since the start of 2020. Their 3.85% mortgage costs $1,500 a month. They are looking at payments of around $4,000 if they move.

Friends who scooped up their forever homes during the pandemic refinancing boom, meanwhile, are able to raise multiple children and support a long-term mortgage comfortably, said Anthony, a 31-year-old accounting consultant. A longtime rule of thumb in American homeownership—buy a starter home, then move up to a bigger place—doesn’t feel like it works anymore.

“It feels like we make too much money to still feel like we’re behind,” Anthony said. Missing the huge repricing “affects all my decisions.”

America has come to expect ever-higher prices on houses, stocks and a swath of other financial assets. Civic leaders and corporate executives routinely praise rising home prices and rallying stocks as signs of widespread economic well-being.

But those rising asset prices are wedging an increasingly large gap between the wealth of older generations and their children and grandchildren. The gains are heavily concentrated in older Americans who are already homeowners and who invested many years ago when prices were lower.

quote:

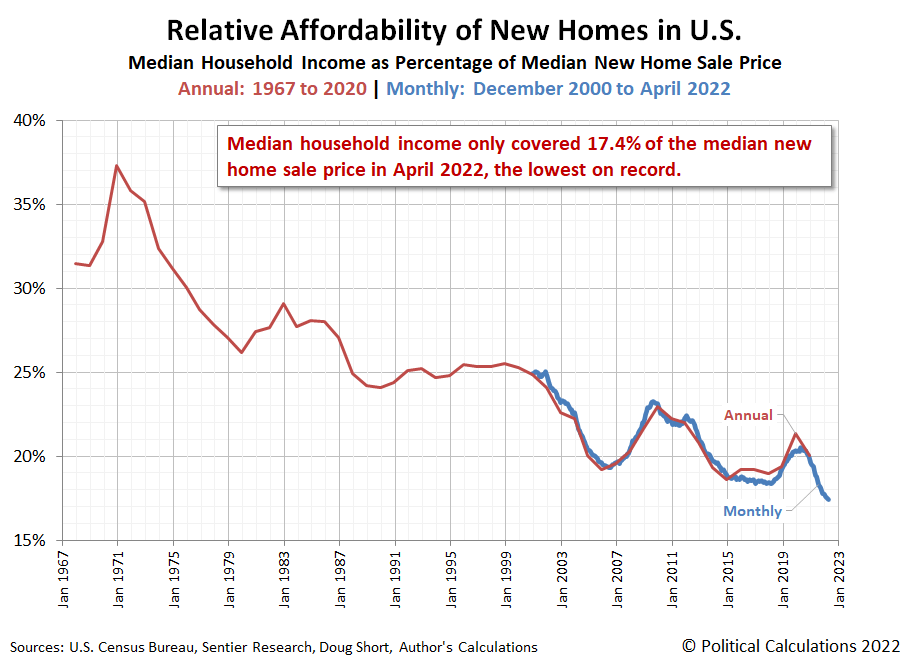

Home-buying affordability fell last year to the lowest level since 1985, according to a National Association of Realtors index. The median household now needs more than 40% of its income to cover payments on a median-priced home, according to the Federal Reserve Bank of Atlanta.

Hopes that the Fed would cut interest rates helped lower mortgage rates and unlock the housing market for a few months, but stubborn inflation has sent rates back above 7% and home sales sliding.

quote:

The Fed supported the housing market for years after the 2008 financial crisis, scooping up trillions of dollars worth of bonds backed by home mortgages. Easy financing conditions helped many Americans get their start into adulthood, while older homeowners benefited from rising prices.

Now, the central bank is running down its portfolio of mortgage-backed securities, helping keep mortgage rates high. But the typical accompanying drop in prices hasn’t happened.

A yearslong decline in housing construction has constrained the supply of houses, propping up prices. Homeowners who refinanced when the Fed slashed rates near zero during the Covid-19 pandemic don’t want to give up their 3% mortgages. A surge in immigration has increased the number of families looking for homes.

Until demand slows or supply increases, home prices will continue to climb. The Fed is still on its front foot trying to tame inflation, meaning mortgage rates are primed to remain expensive.

quote:

Many Americans say they are fortunate to have built their wealth during years when asset prices multiplied, or rates were lower.

Chris Landeck is doing great, despite the high-rate economy. He is worried, though, that the cost of living is crippling for those with few, if any, assets.

A retired petroleum engineer in Brenham, Texas, Landeck paid off his first mortgage long ago. He has also helped his adult children manage their mortgage expenses to pay off the principal as soon as possible. He hammers home the need for frugality and low debt considering how high rates have climbed. He wouldn’t dream of borrowing money now.

“People are seeing prices jumping all around them, but then they turn on the TV and see the stock market at all-time highs,” said Landeck, 68. “That doesn’t offset that dinner costs far more now than it did a few years ago.”

LINK

Count me amongst those who refinanced during COVID. My industry was seeing salaries and day rates getting heavily slashed from about March 2020 to almost the end of that year. My interest rate is now so incredibly low, that while we talk about trying to get closer to our aging parents, if these current rates remain, I'd basically have to hope for a big sale so I can try to pay cash for the next home, which will be downsized, but we would like to have really nice things like outdoor kitchen, etc.

But when you think about it, the current 7% to 8% if what 80s and early 90s babies' parents were used to as the norm.

This post was edited on 4/27/24 at 8:27 am

Posted on 4/27/24 at 8:26 am to ragincajun03

They want it to be like China. Families of 3 generations living in little homes together.

Posted on 4/27/24 at 8:28 am to ragincajun03

Welcome to the Communist States of America

Posted on 4/27/24 at 8:30 am to ragincajun03

Uh, this is what inflation does.

Posted on 4/27/24 at 8:33 am to ragincajun03

We are going this now. Our starter "5 year" home we bought in 2016 has gotten too small for us now with 2 kids.

We have an offer on a bigger house with a yard, but will be selling our house with a 15 year 2.25% mortgage we refinanced in 2020...

We will be almost doubling our mortgage payment even with the move to a 30 year loan.

We have an offer on a bigger house with a yard, but will be selling our house with a 15 year 2.25% mortgage we refinanced in 2020...

We will be almost doubling our mortgage payment even with the move to a 30 year loan.

Posted on 4/27/24 at 8:37 am to ragincajun03

I currently have a 2000 sf home in a decent but not “posh” neighborhood. No way i’m upgrading with today’s prices and rates. Hell, i probably couldn’t afford to buy it today. I regularly get calls and texts from “people” wanting to buy it without even looking at it. My neighborhood has more renters these days than ever. I bet they are paying twice my mortgage in rent.

Posted on 4/27/24 at 8:50 am to ragincajun03

quote:

But when you think about it, the current 7% to 8% if what 80s and early 90s babies' parents were used to as the norm.

Well yeah, but home prices for a starter home were like $75k not $300k. Huge difference when your interest rate is 7%

Posted on 4/27/24 at 8:55 am to ragincajun03

Closed on our home last year and got stuck with 6%. We’ve moved around a lot for work so decided to hold off on trying to buy. It’s affordable for us but our mortgage payment would have been about $1500 less per month if we’d bought about 18 months earlier when you consider rates and housing prices.

I try not to but I think about it everyday

I try not to but I think about it everyday

Posted on 4/27/24 at 9:00 am to ragincajun03

Boomers voted for inflation and high mortgage rates because they want to make sure millenials never own a home

Posted on 4/27/24 at 9:23 am to ragincajun03

They can always work 3 jobs like I do

Posted on 4/27/24 at 9:40 am to ragincajun03

quote:

But when you think about it, the current 7% to 8% if what 80s and early 90s babies' parents were used to as the norm.

This tells only a small part of the story. It's not just about rates. As a percentage of income, homes are more expensive than ever.

In addition, prices for goods have skyrocketed in tandem which makes affordability even worse.

Posted on 4/27/24 at 9:56 am to ragincajun03

quote:

Homeowners who refinanced when the Fed slashed rates near zero during the Covid-19 pandemic don’t want to give up their 3% mortgages.

Ours is 2.3% but this is accurate. We've talked about downsizing in a few years when it's just me and my wife, but it wouldn't be a financially wise decision at this point.

Posted on 4/27/24 at 10:11 am to ragincajun03

quote:

But when you think about it, the current 7% to 8% if what 80s and early 90s babies' parents were used to as the norm.

All my student loans (all paid off by me) were 8% in the mid eighties and my first home in 93 was at 8%, but the other costs of living seem disproportionately higher now.

Posted on 4/27/24 at 10:22 am to ragincajun03

The majority of young voters voted for Biden. So basically they’re getting what they voted for. Elections have consequences and now GDP is falling while inflation continues to persist so rates will continue to be high as well.

Posted on 4/27/24 at 10:39 am to ragincajun03

Young Americans just have to reassess on what square footage is needed vs. what is wanted.

A family of four can do just fine in 1700 sq ft 3Bed2bath...that's what I grew up with.

If you want 4 bed 3 bath and 2500+ sq ft combined income better be 200K+.

A family of four can do just fine in 1700 sq ft 3Bed2bath...that's what I grew up with.

If you want 4 bed 3 bath and 2500+ sq ft combined income better be 200K+.

Posted on 4/27/24 at 10:55 am to ragincajun03

Shockingly honest commentary from MSNBC on this topic.

Loading Twitter/X Embed...

If tweet fails to load, click here.Posted on 4/27/24 at 11:01 am to ragincajun03

Joe and the people actually running the country have done so much damage the last 4 years it’s not even believable. I thought to myself, “how much damage can they do in 4 years?” I think they proved a lot. I don’t know how anyone can defend what’s happened with the economy and inflation. We have lost so much spending power.

Posted on 4/27/24 at 11:13 am to ragincajun03

Just tell the fools poverty is good for the environment. Give 'em nice 3 bedroom ramblers in the metaverse.

Posted on 4/27/24 at 11:36 am to ragincajun03

quote:

Anthony and Caitlin Fumo

will own nothing and like it

Posted on 4/27/24 at 12:14 pm to ragincajun03

In 5 to 10 years we’re going to see a housing surplus and price crash.

Boomers (who own the majority of real estate) will start departing the world in greater numbers, downsizing and into retirement homes.

Boomers (who own the majority of real estate) will start departing the world in greater numbers, downsizing and into retirement homes.

This post was edited on 4/27/24 at 12:15 pm

Back to top

39

39